April News Compilation

Golar - Datagroup- B&M - We connect - Veralia - Auto Partner - Makarrony Polskie

Golar announces 2x 20-year charters

Golar secures 20-year deals for two FLNG projects in Argentina. The agreements are expected to generate a $13.7 billion revenue backlog plus potential upside from gas prices.

Datagroup - Takeover Bid by KKR

A public takeover offer (OPA) for DATAGROUP has been announced by the fund KKR at €54.00 per share. The DATAGROUP management and board support the offer.

B&M European Value Retail (B&M) - FY25 Trading Update

B&M reported full-year 2025 revenues of £5.6 billion, a 3.7% increase year-over-year.

B&M UK: Sales increased by 1.6%, driven by new store openings. However, like-for-like (LFL) sales decreased by 3.1%. 45 new stores were opened during the year, and another 45 are planned for this year.

B&M France: Performed strongly, with revenue growth of 5.6% and LFL growth of 2.6%. 11 new stores were opened.

Heron Foods: Revenues decreased by 2.5%. 14 new stores were opened.

The company expects adjusted EBITDA (pre-IFRS 16) to be above the midpoint of its £605m-£625m guidance range.

B&M also announced progress on CEO succession, with an announcement expected in the coming weeks. More details will be available in the full annual report. Overall, the results appear to be in line with expectations.

http://10baggernewsletter.substack.com/p/b-and-m-european-value-retail-a-bargain

WE Connect - Annual Results and Potential Acquisition

WE Connect has released its annual results alongside an interesting announcement regarding a potential acquisition that could elevate the company to a €500 million sales entity.

Considering the company's current situation and significant upcoming catalysts, this month's new company thesis will be replaced by an update on WE Connect. The thesis will cover the recently released annual results and the potential acquisition.

Verallia

BWGI has submitted a voluntary public tender offer to acquire the shares of Verallia that it does not yet own. The price offered is €30.00 per share (with the €1.70 dividend attached), which will be €28.30 per share once the dividend has been detached on May 13, 2025. The Board of Directors of Verallia has accepted the offer.

The takeover bid is not for delisting, and BWGI has committed not to take the company off the stock exchange for at least 3 years.

In my opinion, the price is too low.

Auto Partner 2025 Annual Results

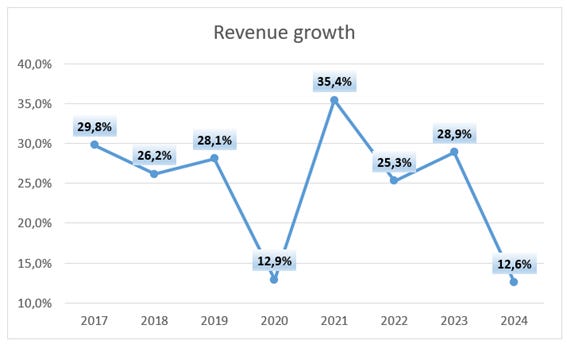

Auto Partner has released its annual results for the 2025 fiscal year, marking another year of growth, albeit at a more moderate pace compared to previous years.

Revenue: The Polish company achieved revenues of PLN 4,112.5 million, representing a 12.6% increase. This growth was achieved despite headwinds from deflationary pressures from automotive parts manufacturers and the appreciation of the euro against the Polish złoty compared to 2023. Importantly, in terms of volume, the company's growth was even higher.

Profitability: Regarding profitability, gross profit reached PLN 1,127.2 million, with a slight improvement in margins, achieving a gross margin of 27.4% (compared to 27.1% in 2023). However, EBITDA and EBIT experienced declines, settling at PLN 343.6 million and PLN 289.3 million, respectively, representing a decrease of 0.8% and 4.4%. The corresponding margins were 8.4% for EBITDA and 7 % for EBIT.

This decrease in operating profitability was primarily due to the increase in the minimum wage in Poland and expenses related to the opening of two new subsidiaries in the Czech Republic and Germany, as well as the setup of the new distribution center in Zgorzelec, which is expected to open in late 2025 or early 2026. Currently, both the new subsidiaries and the distribution center have only generated expenses, without contributing to revenue.

Profit before tax amounted to PLN 258.6 million, a 6.7% decrease, due to a 4.96% increase in financial costs and a notable decrease in financial income. Finally, net profit stood at PLN 207,976 million, generating an earnings per share (EPS) of PLN 1.59, 7% lower than in 2023.

Balance Sheet: The company presents a robust balance sheet, with a net debt to EBITDA ratio of 0.8 times, indicating prudent financial management.

Free cash flow: Reached PLN 6.1 million, impacted by working capital outflow of PLN 180 million to finance growth and a 20% year-on-year increase in capital expenditures, mainly related to the investment in the new distribution center.

Outlook and Conclusion:

Despite an environment of deflationary pressures from manufacturers, Auto Partner's business growth has been positive. However, this growth has been the most moderate in recent years.

The beginning of 2025 has continued this trend of slower growth, registering a 7.91% increase in the first quarter, compared to 18.9% in the same period in 2023. For the coming quarters, an acceleration of growth is expected, driven by a more favorable comparative base.

However, the real turning point towards a return in growth is expected in 2026, with the opening of the Zgorzelec warehouse. This new infrastructure will increase the company's storage capacity by 30% (excluding branches) and, in addition to expanding its potential market, will reduce delivery times to existing customers in nearby areas, strengthening its competitive position.

In addition, the Company does not rule out future warehouse openings, particularly in Germany and the Czech Republic, taking advantage of the recent opening of its subsidiaries in these markets

In this regard, 2025 is shaping up to be a transition year, after which, starting in 2026, the combination of the opening of the new distribution center and the likely expansion of its logistics network in Europe could propel Auto Partner to resume annual growth rates of 15% to 20%.

As for margins, they seem to have stabilized after a few years of exceptionally high margins during the pandemic. While no significant improvement is expected, they are expected to trend upwards, driven by the greater weight of international revenues (which generate higher operating margins) and the future contribution to revenues from the Zgorzelec logistics center.

Auto Partner currently trades at 12.4x P/E, a valuation that in my opinion is attractive for a defensive business that is expected to deliver sustainable growth rates of 15% to 20% after a transition year in 2025.

Makarrony Polskie Annual Results

Sales: Makarrony reported sales of PLN 303.3 million, a decrease of 14.5% compared to the previous year. This decline is mainly due to the reduction in the prices of key raw materials compared to 2023, which remained stable during 2024. Another negative impact was the end of the VAT exemption for certain foods in 2024.

Gross Profit, EBITDA, and EBIT: The company reported a Gross Profit of PLN 87.1 million, an EBITDA of PLN 56.1 million, and an EBIT of PLN 41.4 million.

Record Profitability Despite Headwinds: Despite the challenges in terms of revenue, Makarrony achieved record profitability in 2024, with a gross margin of 28.7% (compared to 27.6% in 2023), an EBITDA margin of 18.6% (vs. 16.3% in 2023), and an EBIT margin of 13.7% (vs. 12.3% in 2023), generating PLN 87.1 million in Gross Profit, respectively.

According to the company, this improvement in margins is a result of investments made in previous years, which began to pay off in 2023. We recall that the company implemented a significant investment plan during 2018, 2019, and 2020 to focus on higher-margin products, such as premium, gluten-free, and ready-to-eat meals, among others. It seems that this strategy has been successful, significantly increasing its gross margin and practically doubling its operating margins.

Net profit reached PLN 33.7 million, a 2.4% increase compared to 2023. This was due to financial income exceeding financial expenses, thanks to the company's strong net cash position and a lower tax rate.

Balance Sheet: Excluding leases, the company has a net cash position of PLN 39.1 million, against a market capitalization of PLN 209 million.

Cash Flow: Free cash flow amounted to PLN 35 million, above the net profit. This is explained by depreciation exceeding Capex, a result of the high Capex carried out during the 2018-2020 period.

Future Strategy: The company's strategy of focusing on premium and higher value-added products to improve profitability appears to have been successful. Therefore, in the coming years, they will continue to invest in this direction with a PLN 40 million investment program for the Korpelach plant, of which PLN 29 million will be executed in 2025. Thanks to the investment being made under the Polska Strefa Inwestycji (Polish Investment Zone), the company will benefit from a tax exemption of up to PLN 14.5 million.

Additionally, its subsidiary Stoczek Natura Sp. z o.o. is also investing approximately PLN 20 million in modern machinery to expand its production capacity for ready meals in trays and doy-packs.

The company is also open to investing in inorganic growth and is looking for potential acquisitions, but will only undertake them at the right price, as they stated that they "highly respect shareholder money," which is believable given that the CEO is the largest shareholder with 33% of the capital.

Valuation and Personal Conclusion: The company's valuation seems ridiculous to me. We are looking at a food company resilient to any type of crisis, trading at a P/E of 6 and an EV/FCF of 5 times, with 18.6% of its market capitalization in cash.

Personally, there is one aspect that makes me somewhat cautious: current margins are at historical highs, and a return to previous levels could halve the profit. While the company attributes this improvement entirely to efficiency gains and investments in higher-margin products, I cannot be completely sure of this. I believe this uncertainty is the reason for its low valuation, and therefore Makarrony does not have a larger weight in my portfolio.

However, my personal opinion is that most of the improvement does come from the implemented strategy, especially considering that, following the results of the previous investment plan, the company will undertake another one in the coming years, which, knowing that the CEO is the largest shareholder, makes me quite comfortable.

In 2024, raw material prices have been more stable, so if margins are maintained in the Q1 2025 results, it will be demonstrated that the improvement comes from the product mix.

On the other hand, the company is constantly buying back shares whenever they trade below PLN 20, and in the letter to shareholders, the CEO has stated their intention to continue buying back due to the undervaluation of the stock.