Auto Partner investment thesis updated

This is a company that I have owned in my portfolio since 2022 and was one of the first companies that I uploaded to the blog when I was writing in Spanish. Although the thesis has not changed much du

Auto Partner in brief

- Growing company in a stable automotive aftermarket industry

- Founder-led

- Good track record of growth

- Less than 2% market share in a consolidating industry where the only competitive advantage is scale

About Auto Partner

Founded in 1993 by its current CEO and major shareholder, Auto Partner is an aftermarket parts distributor for cars, light trucks and motorcycles.

Auto Partner is a story of success and growth, with excellent performance since its IPO in 2016:

The business model is easy to understand basically, the company acts as a logistics platform and distributes the purchased spare parts to the end customers, which are mainly workshops and specialized shops. In Poland, 62% of its customers are workshops, 30% are specialized shops and the remaining 8% are non-specialized shops.

As for exports, 100% are made to shops and other distributors, which means that international sales generate a lower gross margin but a higher operating margin.

70% of its sales are already online, of which 99% are international. This is very interesting and is one of the competitive advantages that companies achieve when they reach a certain size. Developing this sales platform together with a good IT system is costly and not feasible for smaller companies.

A customer's choice of a wholesaler is based on price, product mix and delivery time. The only competitive advantage to compete profitably on these 3 aspects is scale. This means that with each new branch or warehouse you open, the company becomes more competitive.

The company offers products from more than 350 suppliers, offering more than 250,000 different references. In addition to third party products Auto partner has several own brands, the main one being Maxgear which represents about 20% of sales generating a higher margin.

The products sold are:

It is interesting to note that the company does not sell products such as tires, which are an important part of market. Why is that? Because tires require more storage space, leave less margin, and Auto Partner has a large enough market to focus on the products it is most interested in. Adding new products like tires can be a source of growth for the company in the future.

To build customer loyalty, the company has developed a chain of workshops under the Maxserwis brand. The company does not own or operate these garages but offers them benefits including preferential discounts, lease of workshop equipment, participation in technical training and conferences, and being listed on https://maxserwis.com.pl/ a list of quality garages for car owners. This practice is quite common and can be seen in competing companies such as LKQ and Inter cars.

The company is part of Global one automotive, an association of distributors whose aim is to reach better agreements with suppliers and exchange information among themselves. This allows them to better compete with the large companies in the sector. One of the requirements is to be a family business.

Spare parts are imported to the main distribution center in Bierun, from where they are dispatched to other warehouses and the company's network of branches throughout Poland.

Facilities:

Main distribution center in Bierun (52000 m2).

Distribution center and warehouse in Poznan (13500 m2).

Warehouse in: Mysłowice - (24,000 m2).

Warehouse in Pruszków (approx. 12,500 m2).

Local warehouses in 116 branches (approx. 57,000 m2) all over Poland.

Local warehouses in two branches in Prague, Czech Republic (approx. 1,200 m2).

The company is in the process of opening a new distribution center in Zgorzelec in late 2025 or early 2026 (30,000 m2).

The opening of the new distribution center in Zgorzelec will significantly improve the Company's competitive position in Europe by shortening delivery times. Currently, in some areas of Europe they make one delivery a day and can only guarantee the next day delivery (they deliver at night), while in Poland they make 3 to 5 deliveries a day. This is not a problem now because internationally they only sell directly to specialist stores, so they do not need the same speed of delivery as a workshop, but if they want to maintain the growth rate it is necessary.

Growth Strategy

The Company will continue with the same growth strategy focused on

- Continuing to increase the scale of operations

- Further product diversification

- Further increase profitability

- Expanding sales in foreign markets

Industry

The independent aftermarket (IAM) industry has an anti-cyclical component that generally works well in any economic environment but especially in times of economic downturns. When, due to a crisis, the sale of new vehicles decreases, this causes an increase in the age of the vehicle fleet, resulting in the need for more maintenance.

The main factors driving the market are the size of the car fleet, the age of cars and the miles driven. In general, a car becomes a target for the industry at the end of its warranty period.

First, let us understand the value chain

On the one hand, we have the OEMS, whose parts are generally distributed through official workshops. These have a higher cost to the end customer and most of these workshops are used for vehicles under warranty.

On the other hand, there are the so-called IAMs (independent aftermarket), which are independent workshops and distributors, i.e. different from the OEMS. In the second step of the value chain within the IAM we have the distributors as Auto Partners.

There are several trends underway that may affect the industry; we will mention them all, but we will focus on the two most important: electrification and market consolidation.

We will start with the trends that may pose a challenge:

- Private label parts are growing Distributors are selling private labels, such as Auto Partner's Maxgear.

- Online sales are gaining market share: This makes it very important for distributors to have a good IT service and a good online sales platform. In the case of APR, 70% of sales are online (99% for imports).

- Safety technology to reduce crashes. The real threat along with the self-driving car.

- Electric cars require less maintenance.

Electrification:

This is an important and complex trend that we need to explore further. First, we will look at how it may affect the industry, what distributors think, and when and who it will affect. To study the impact, we will use a report by Roland Berger in collaboration with CLEPA.

The electric car would affect the industry in the form of a reduced need for parts, resulting in lower maintenance costs. It is estimated that an electric car has about 30% less parts costs than an internal combustion vehicle.

The report shows 3 scenarios for 2040, all very optimistic for the electric car, the most negative scenario is that the goal of no more combustion engine cars being sold in Europe by 2035 will be achieved. Something quite optimistic since several countries, including Germany, have shown their opposition due to the importance of the industry in Europe.

Japanese manufacturers are betting on alternative technologies with the intention of continuing to use the internal combustion engine. A few days ago, an alliance was announced between Toyota, Subaru and Madza to develop a new generation of internal combustion engines that run on alternative fuels.

Scenarios at 2040

1 - Regulatory compliance: Electric cars represent 42% of the total fleet and 13% of the traditional aftermarket.

2- Ambitious transformations: Share of electric cars in the total fleet, 52% and contraction of the traditional aftermarket, 16%.

3- Radical electrification: Share of electric cars in the total fleet, 54% and contraction of the traditional aftermarket, 17%.

Despite being very optimistic scenarios with electrification, in the worst-case scenario in 2040, 46% of the fleet would still be combustion vehicles. This is because although the electric car is gaining share, replacing the vehicle fleet will take time. In 2023 there were 10.5 million new car registrations of which 15% were electric. According to Eurostats in 2022 in Europe there were 252 M Passenger cars, if during 2023 10.5 were sold assuming a constant total number of cars 4.1 % of the fleet was replaced, and of that 4.1 % only 15 % were electric. In 2022 only 1.2% of the cars in circulation were battery electric cars.

The countries where electric cars have the greatest weight are the Nordic countries and rich countries in Europe, while auto partner focuses on Central and Eastern Europe where the electric car has less penetration.

On the other hand, the electric car is causing buyers to delay the change of car due to uncertainty with the technology, causing the average age of cars to increase.

Positive trends

The average age of cars is increasing and is 12.3 years in Europe (ACEA) and 14.2 years in Poland (Statista).

The fleet of vehicles in circulation is growing slowly, from 2016 to 2022, it has grown at 1.1% per year (EUROSTAT).

The market is still fragmented and in consolidation.

This consolidation is being pursued mainly through mergers and acquisitions.The entry of companies such as LKQ, GPC or private equities such as Bain Capital former owner of PHE which was acquired by D`leteren Group in 2022, are driving the market to consolidation. LKQ since 2011 has made more than 80 acquisitions in Europe and GPC through its subsidiary Alliance Automotive Group made 26 acquisitions since 2018. Most of the acquisitions are smaller players operating locally.

Despite this high number of acquisitions, the market remains fragmented, and according to Parts Holding Europe (PHE), the IAM market ITS valued at 50 B €, with the top 10 players holding 33% of the market. In a market where scale is the only competitive advantage, this trend is likely to continue, and all market trends are hurting smaller companies the most. Smaller players are either being acquired or losing market share, and all indications are that this trend will continue. Based on this data, Auto Partner has only a 1.7% market share at the European level.

Poland Market

The Polish market is valued at approximately 14300 M PLN (source: MEKO AB.) It is dominated by Inter Cars with 54% share, Auto Partner with 13% and Meko which, with its latest acquisition, has gone from 5% to 8%. This means that between 3 players they have 75% of the market, while if we look at the European level, the top 10 have only 33%. From the comments of the MEKO management, it seems that the rest of the players are very small.

About the latest Meko acquisition: Meko was present in Poland through Inter team acquired in 2018 and this May it was announced that it has reached an agreement to acquire Elit Polska which is the brand under which LKQ was operating in Poland and had a market share of about 3%. About this acquisition I do not know to what extent it is good for MEKO's interests as LKQ is the majority shareholder of MEKO with 26 % of the capital and this may have influenced the decision but as the target of the thesis is not MEKO, we will leave the speculations. Just to say that MEKO is much less efficient than auto partner in Poland with EBIT margins of 4 %.

In addition to exiting Poland, LKQ has reached agreements to divest in other markets such as Slovenia and Bosnia.

These divestments show us that size matters in this business, but size in the right place. In other words, being the leader in Spain may give you the scale to enter Portugal, but it does not help you in Germany. What I mean by this is that scale and size are important, but concentrated, and this is something that Auto Partner does very well, growing like a spider's web, which allows it to be competitive, because if it is true that its share is small at the European level, this way of growing allows it to have sufficient scale in the areas where it operates.

In my opinion, this can also be used to speculate on how the market may look in the future when it consolidates. It seems that it will be divided along regional lines, with companies like GPC, LKQ and PHE, although present in many countries, focusing on Southern and Western Europe, Nordic companies like MEKO or Relais in the Nordic countries, and Inter cars and Auto partner in Central and Eastern Europe.

Why do I believe in market consolidation? Besides the fact that it is happening , because of the importance of scale.

Why is scale so important?

Small companies have many disadvantages:

They cannot afford to invest in a powerful IT system.

They cannot create their own network of workshops.

They cannot have their own private label brand.

They serve fewer customers on each trip.

Delivery times are longer.

They have a smaller catalog.

Management

The Company is managed by its founder and largest shareholder, Aleksander Górecki, with 43.6% of the shares.

Other key managers are

Andrzej Manowski: a partner of the Company practically from the very beginning, he has been the Vice President since 2007. He is responsible for coordinating and optimizing the Company's business activities and supervising IT systems.

Piotr Janta: Sales Director since 2009.

Tomasz Werbiński: CFO, in the company since 2019.

The performance of the management has been excellent so far, which is reflected in the results. Salaries are not excessive, especially that of the founder.

This low Founder's salary is, we understand, the reason why the company pays a small annual dividend with a payout of 8.8%.

Financial analysis

P&L

Revenue: Growth has been impressive and purely organic, growing at a CAGR of 26.4% since the IPO. Revenue should be looked at regionally. Growth in Poland has been very good with a CAGR of 16.2%, but international growth has been even better with a CAGR of 35.9%. This is very interesting because in 2023 international sales account for 50% of the total, which together with the consolidation situation and the low market share will allow the company to continue to maintain a high growth rate.

In Q1, sales grew 18.9%, but March was a bad month with fewer working days compared to last year, which meant that in March sales grew only 5.18%, but in April the growth was 22.69%. The company does not give guidance, but in the last conference call they said that except for March, the growth in the rest of the months can be a good guide for what they expect in 2024.

Gross margin: Gross margin has increased with the size of the business but is not expected to return to pandemic levels for several reasons. Firstly, because competition was less aggressive in the pandemic period and secondly, because international sales have a lower gross margin but a higher operating margin due to the different type of customer. One of the main variations in the company's margins comes from foreign exchange. The company's inventory turnover period, although improving, is high with127 days Q1 2024 VS 141 Q12023, which makes fluctuations in the zloty against the euro affect its gross margin sometimes positively and sometimes negatively, but in the long term it should be neutral.

Operating Margin: The company's main costs after COGS are distribution, marketing and warehousing. The sum of these 3 costs has usually been between 19% and 20% of sales, items that seem important to analyze separately to see where the variation in margins comes from and mostly comes from the gross margin. In the first quarter of 2024, warehousing costs have increased, most of which are fixed costs, so the reduced number of working days in March had an impact, and especially the construction of the new logistics center, which is not yet generating revenues but is already generating some expenses.

Balance sheet

The company has a capex-light business model with its largest investment being working capital. For this reason we will focus on debt, working capital and returns on capital.

Debt: The company is in a good financial position with a low level of net debt to EBITDA compared to historical levels. This is due to the rise in interest rates in Poland, which made debt more expensive, and they decided to reduce it. Inflation in Poland has normalized, and we have seen the first declines in interest rates, and as these decline further, Auto Partner will likely rely more on debt to continue to grow.

Working Capital: Working capital is the company's largest investment and had increased its level over sales during the pandemic, increasing its investment in inventories as a precaution against any problems in the supply chain. In 2023, the level has returned to normal and is at a level management feels comfortable with.

Returns on capital: Both ROIC and ROE are above average.

Cash Flow

As with all distributors as they grow, free cash flow lags behind net income due to the investment in working capital needed to grow and will continue to do so as long as the company maintains these growth rates. Something I am not concerned about as long as returns on invested capital do not decline from current levels.

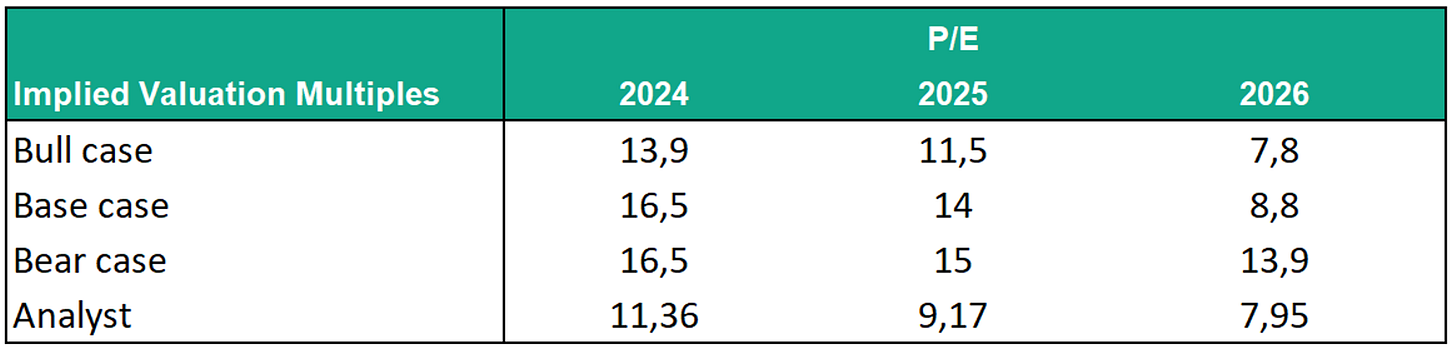

Valuation

The company is currently trading at a P/E of 14x 2023, and even though Q1 earnings were down due to margins. I think margins will improve vs. Q1, but will likely be slightly impacted this year and next until the new logistics center is ready in late 2025 or early 2026, which currently only generates costs but no revenue.

Valuation in terms of its listed PERS and M&A

Auto Partner does not appear to be trading at a large discount to its peers, but it is the fastest growing company in the industry and all of its growth is organic, which is usually cheaper.

Valuation by DFC

As Warren Buffet says, let's go with the "funny papers". This part of the thesis is the one I least like to publish because it is based on estimates and as we know Excel can do it all, so you can skip this part, it is simply a valuation exercise.

Here we are going to present 3 scenarios not with the objective of trying to guess exactly how much the company is going to earn but with the intention of trying to find a suitable entry price.

Bull case: We assume 20% growth for the next 3 years and then normalization with a gradual decline in growth of 2% per year until 2030. Gross margin of 28% and EBIT of 7% by 2024 and 2025, and 8.5% after the opening of the new logistics center.

Base case: 20% growth this year and a gradual decline of 2% until 2030. Gross margin of 27.5% and EBIT margin of 6% in 2024 and 2025, and 8% after the opening of the new logistics center.

Bear case: Growth of 20% this year with a decline to 10% in 2025 and a decline of 2% per year until 2030. Gross margin of 26.5% and EBIT margin of 6 %.

Only 1 analyst follows the company, and he seems to be more optimistic than I am, especially on the margin side.

Conclusion and basis of the thesis

The thesis is based on the fact that this is the fastest growing company in a stable and consolidating sector where size is the only competitive advantage, with an estimated market share of 1.7%.

To quote another great investor, this company reminds me very much of the Peter Lynch style: a high-growth company in a mature and boring sector, family-run, which has already shown that it can expand successfully and still has plenty of room to grow.

However, we must not forget the risks that have been mentioned about the industry in general and for Auto Partner in particular, the deterioration of margins, which, although they will not be as high as between 2020 and 2022, I hope they will be better than before the pandemic, something that the board has already said.

At 14 times earnings, it may not be a bargain, but if the expectations of consolidation in the sector and growth of the company are met, it could interesting.

Disclaimer: This is not an investment recommendation, but a personal opinion. The author is an investor in the company at the time of writing, so his opinion may be biased.

Dont you think that Inter Cars would be a better play? it is larger and growing not less that Auto Partners?