B&M in nutshell

B&M European Value Retail S.A. is a variety discount retailer operating in the UK and France. The company offers a wide range of products, including groceries, general merchandise, and home goods, at affordable prices.

Company Growth: 26.6% CAGR over 18 years.

High returns on invested capital: ROIC exceeding 20%, 30%+ ex-goodwill.

Recent Correction: Stock down nearly 50% in the last 12 months post 2 profit warnings (only 6.3% earnings decline expected).

Shareholder Returns: 60%+ of current market cap returned via dividends (FY21-24).

Cheap valuation: Trading at 7,5 earnings.

A brief history of B&M

The company was founded in 1978 and opened its first store in Blackpool. In 2004, B&M was taken over by Simon and Bobby Arora. With the acquisition, B&M underwent a remarkable transformation from a modest chain of 21 stores on England to a group of 1246 stores with presence in the UK and France.

Important events:

2014: Acquired majority stake in German discount chain Jawol, kicking off international expansion.

Begins trading on the London Stock Exchange.

2017: Acquisition of the entire issued share capital of Heron Foods Group, a value convenience store chain in the UK.

2018: Acquisition of the Babou convenience store chain in France.

2020: Divestment in Germany due to lack of profitability.

2022: Simon Arora steps down as CEO and Alex Russo takes over.

2025: Announcement of Alex Russo's resignation as CEO and a profit warning for the second time this year.

Business Overview:

B&M is a discount retailer. B&M offers a targeted range of branded convenience grocery products, encompassing ambient food, soft drinks, confectionery, and alcohol. This is complemented by Fast-Moving Consumer Goods (FMCG) categories, including toiletries and cleaning products, and General Merchandise across a broad spectrum of product categories such as homewares, electrical, gardening, toys, and DIY. B&M focuses on "best-selling" items. This strategy enables the company to procure large volumes of selected Stock Keeping Units (SKUs), generating significant purchasing power and allowing them to benefit from advantageous buying terms.

Discount retailers are generally considered defensive businesses due to their emphasis on low prices. However, they are not entirely immune to economic fluctuations, as B&M sells certain products that can be considered discretionary. Approximately 50% of their sales are attributed to FMCG, with the remaining 50% derived from General Merchandise. The company maintains that its General Merchandise offerings are not particularly cyclical.

Unlike some other discount retailers that focus primarily on private label brands, B&M focus is on well-known branded products. This differentiates them and appeals to customers seeking recognizable brands at discounted prices.

This business model demonstrates significant profitability and scalability once the optimal store model is achieved, as evidenced by the American companies Dollar Tree with over 16,000 stores and Dollar General with over 20,000

B&M UK

The UK segment is B&M's core and most profitable business line, contributing approximately 80% of total revenue and 88% of adjusted EBITDA. Adjusted EBITDA figures are provided by the company, with the primary adjustment related to IFRS 16 accounting standards, facilitating a more accurate comparison with prior periods. This segment is the primary driver of profitability and the central focus of the company's growth strategy.

Initially, the company's target was to reach 950 stores in the UK. However, in 2024, this target was revised upwards to 1,200 stores. This target implies a 62% increase in store count from the fiscal year 2024 closing figure. According to the Management the new stores are larger and more profitable, generating higher sales volumes, suggesting that revenue growth will potentially exceed the 60% increase in store count.

The company states a 1-year payback period on new store openings, or 9 months excluding working capital

As evidenced in the table, the company's sales have demonstrated consistent growth, not only in absolute terms but also on a like-for-like (L-F-L) basis. L-F-L sales experienced a decline only in 2022, following a particularly challenging comparison with the exceptionally strong performance of 2021. Furthermore, the company has achieved a notable margin expansion as it has scaled its operations. Management stated that post-pandemic normalized adjusted EBITDA will be in the range of 12-13%.

B&M France

In 2019, B&M acquired the Babou chain of stores in France, pursuing a different strategy than its failed expansion in Germany. Unlike Jawoll, Babou was already a profitable business, however, it was struggling to grow. B&M took a cautious approach to expansion in France, prioritizing the rebranding of the chain, which was completed in 2022, with an initial opening rate of 3 to 5 stores per year.

Babou's sales mix differed significantly from B&M's in the UK, with a higher weighting of general merchandise, particularly clothing. Following the rebranding, the company has been adjusting the mix to align with the UK model, increasing the proportion of FMCG in sales.

As the table shows, store growth has been moderate, impacted by both rebranding and the pandemic-related slowdown. With a population similar to the UK, B&M believes that France has the potential to grow at the same size as the UK and that the market is less competitive. The management team recognizes the need to optimize certain operational aspects but sees the ability to expand the network at a rate of 15 to 25 stores per year in the future.

In terms of EBITDA margin, there is a significant improvement, especially from 2022 onwards, following the implementation of the B&M model. The company expects to achieve an adjusted EBITDA margin of 10% in the medium term and similar levels to the UK in the long term, although no specific timelines were provided.

Heron Foods

Acquired in 2018, Heron Foods is a convenience store chain operating in local neighborhoods and shopping parades. Heron Foods offers value-driven pricing on frozen, chilled, and ambient food products. The company primarily operates in the North of England and currently has 340 stores as of December 28, 2025. The company believes that the chain has the potential to expand multiple times its current size by extending its presence into other regions , in a market where the sector leader operates over 2,000 stores. They anticipate opening between 15 and 20 new stores annually.

This acquisition was strategically significant, not only due to its growth potential but also because it created valuable synergies with the B&M chain. As a result of the acquisition, B&M introduced frozen and chilled food products into its sales mix, while Heron Foods stores benefited from the group's scale, leading to improved purchasing terms.

Although the company has not provided exact like-for-like (L-F-L) growth data, it is evident that sales have grown at a faster rate than the number of stores. This growth is attributed to the benefits of being part of a larger group and the ability to introduce branded products at affordable prices.

In terms of margin, the integration has been positive, with margins improving since joining the group.

Indsutry overwiew

The discount retail sector is characterized by offering products at significantly lower prices than traditional retailers, making it a defensive sector.

The UK value, discount, variety stores, and general merchandise retail market was valued at £46.9 billion in 2022 and is forecast to grow at a compound annual growth rate (CAGR) of more than 4% between 2022-2027. The retail channel is set to grow as more shoppers turn to value-focused retailers to make their budgets stretch further during the cost-of-living crisis. (Source: Globaldata).

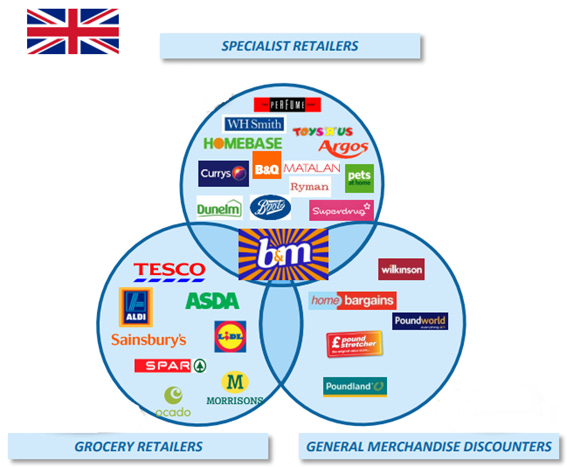

Depending on the product, the Company competes with different types of companies.

Grocery Retailers: Grocery Retailers: In this segment, B&M competes primarily with large chains that focus on food products, with a strong emphasis on private label brands. Despite being competitors in food product sales, B&M is often highly complementary to these companies, particularly Lidl and Aldi. Many of B&M's best-performing stores are located near these two discounters.

Specialist Retailers: This category includes a wide range of competitors in sectors such as DIY, gardening, furniture, homeware, electrical goods, and pet supplies.

General Merchandise Discounters: This segment represents the most direct competition, although most of these retailers do not offer food products.

Post-pandemic retail market dynamics

The retail sector faced significant headwinds following the pandemic, particularly wage inflation, with the national minimum wage increasing by approximately 20%. In 2023, the sector experienced significant job losses, with 120,000 jobs cut and 10,000 store closures reported (Retail Gazette, January 8, 2024). Ongoing economic uncertainty continues to impact the sector, as evidenced by a modest 0.7% growth in retail sales in 2024, as reported by the British Retail Consortium (BRC).

Food retailing has shown resilience, with a 3.3% increase in sales, while non-food retailing has shrunk by 1.5% compared to 2023. The BRC forecasts average retail sales growth of 1.2% in 2025, which is expected to be below the estimated inflation rate of 1.8%.

Growth Strategy

The Company has a clearly defined long-term growth strategy, prioritized by profitability and based on four key pillars:

Like-for-like (L-F-L) sales growth in the UK: Each 1% increase in L-F-L sales is equivalent to the sales generated by approximately seven average store openings, highlighting the efficiency of driving existing store performance.

New B&M UK store openings: The company aims to expand its UK footprint to 1,200 stores, demonstrating its commitment to organic growth in its most profitable market.

B&M France expansion: Growth in France will be driven by both L-F-L sales improvements and new store openings, with a target of 15 to 25 stores per year.

Heron Foods Development: Heron Foods remains a significant long-term growth opportunity with a planned store opening program of approximately 20 stores per year.

Financial Analysis

B&M has demonstrated consistent growth in all economic environments, achieving a compound annual growth rate (CAGR) of 26.6% over the past 18 years. To mitigate the potential impact of the lower starting base and provide a more conservative perspective, the CAGR over the past 10 years is 15.7%. Furthermore, this growth has been profitable, with margins expanding as the company has scaled its operations. The current adjusted EBITDA margin is 11.5%.

Return on Invested Capital (ROIC)

B&M has demonstrated a strong ability to generate high returns on invested capital.

From 2014 to 2019, the company achieved an average ROIC of 14%. It's important to note that this period included the operation of a loss-making subsidiary that was divested in 2019.

Following the divestiture and subsequent operational improvements, B&M's ROIC has increased significantly. Between 2021 and 2024, the company generated an average ROIC of 21.6%.

Furthermore, when calculating invested capital excluding goodwill, B&M's ROIC exceeds 30%.

Debt

B&M uses debt to support its growth strategy and typically maintains a ratio of net debt (excluding leases) to EBITDA within a range of 1 to 2 times. Current net debt (excluding leases) is £788 million, which represents a leverage ratio of 1.3 times based on the lower end of the 2025 guidance.

Cash Flow

B&M has consistently generated a positive cash flow. Prior to the pandemic, free cash flow , while consistently positive, was slightly lower than net income due to investments in new store openings. Since the pandemic, as the pace of store expansion has slowed, FCF has become more in line with net income. In the most recent financial year, the company generated FCF of £332 million compared to net profit of £367 million.

B&M's business model is capex-light, as its stores are leased. This leasing strategy gives the company greater flexibility to relocate underperforming stores. Maintenance capex is less than 1% of sales.

Management and Ownership

Simon Arora led the company until 2022, when Alex Russo assumed the role of CEO. On February 24, 2025, the company issued a statement announcing Alex Russo's intention to step down, in addition to a profit warning that lowered EBITDA guidance.

The company is currently searching for a new CEO. This development creates uncertainty, although the reasons for Alex Russo's departure - whether voluntary, personal or related to the company's recent performance - remain undisclosed.

The major shareholders are institutional investors, with the Arora family being the only insiders holding a significant position. In late 2023, following the departure of Simon Arora, his family investment vehicle, SSA Investments S.a.r.l., sold a significant number of shares, representing 2.8% of the outstanding shares, at a price of £5.81. They currently hold a 4.2% interest in the Company. Bobby Arora remains as trading director. B&M has clarified that the share sale relates to shares beneficially owned by Simon and Robin Arora and that Bobby Arora's shareholding remains unchanged.

The ongoing search for a new CEO creates uncertainty, which is generally not well received by the market.

In January and February, several mutual funds with significant positions reduced their holdings slightly, just prior to the announcement of the revised guidance and the CEO's resignation. It is unclear whether there is a correlation between these events.

On a positive note, several members of the Board of Directors have recently purchased shares at prices above the current market valuation.

Capital Allocation

B&M's capital allocation policy is based on the following priorities

1. Investment in organic growth: This includes capital expenditures for new store openings.

2. Ordinary dividend: The Company targets a payout ratio of 40-50% of earnings.

3. Mergers and acquisitions (M&A) opportunities

4. Return of excess cash to shareholders: Achieved through special dividends.

B&M has a history of returning excess cash to shareholders through special dividends. Over the last four fiscal years (2021-2024), the company has paid out £1.8 billion in dividends, a significant amount given the current market cap of £2.7 billion.

In its Q3 trading update, the company announced a further special dividend of 15 pence per share, amounting to £151 million.

Valuation

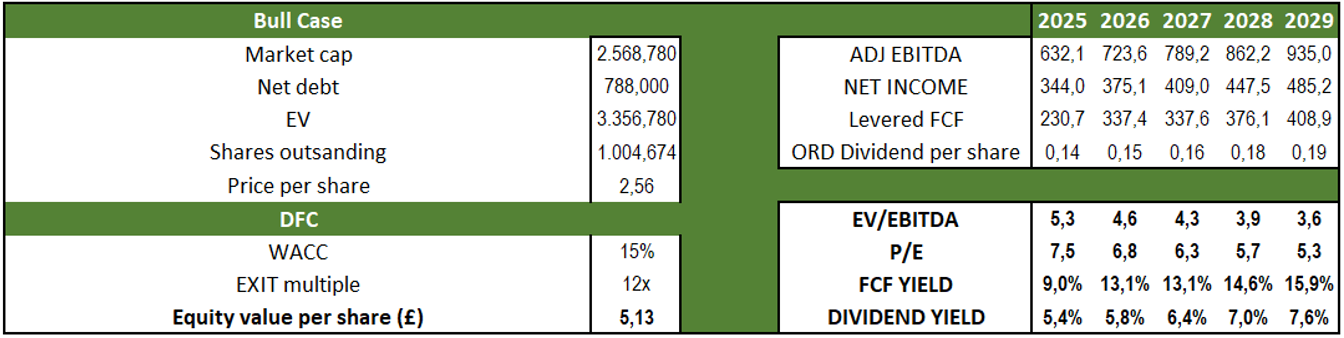

For fiscal year 2025, the company has provided adjusted EBITDA guidance ranging from £605 million to £625 million, which, according to analyst consensus, translates to a net profit of £344 million. My own estimates suggest a net profit of £349 million; however, we will use the consensus figure. This implies a 6.3% decline in net profit.

Concurrently, the company's share price has decreased by nearly 50% over the past twelve months.

Preliminary Valuation

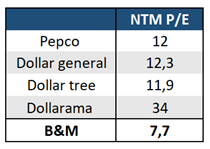

At current prices, the company trades at a next-twelve-month (NTM) P/E ratio of 7.7, a NTM EV/EBITDA multiple of 5.5, and a dividend yield of 5.5%, excluding special dividends.

Valuation based on comparable companies

Companies with similar business models tend to have higher valuation multiples. The following table provides an illustrative comparison

Even excluding Dollarama, B&M trades at a significant discount, even though companies like Dollar General and Dollar Tree are currently trading at significant discounts to their historical averages. In addition, B&M has a higher growth rate than these peers.

Valuation using historical multiples

An analysis of B&M's historical trading multiple reveals an even more significant discount.

Preliminary Valuation Conclusion

On an absolute basis, B&M trades at very attractive multiples, especially for a company with consistent growth and strong returns on invested capital.Compared to companies with similar business models, B&M trades at a significant discount, even considering that these peers are currently trading below their historical averages.An analysis of B&M's historical trading multiples further confirms the significant discount.

This is a good starting point.

B&M is a company with plenty of room to grow. If we make conservative assumptions about the future, it looks even cheaper.

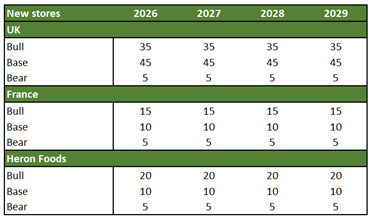

To put this in context, it is important to recall the company's stated expectations for the future:

· B&M UK: Long-term target of 1,200 stores, with 45 new store openings planned for fiscal 2026. Adjusted EBITDA margin of 12% to 13%.

· B&M France: Short-term target of 10 to 15 new store openings per year, with a medium- to long-term target of 15 to 25. Medium to long-term margin convergence with B&M UK.

· Heron Foods: Target of 20 new store openings per annum.

· In all three chains, new stores are expected to generate higher sales than existing stores.

Assumptions and valuation

Based on this we will take conservative assumptions

Margin improvements and increased revenue per store in new locations are not factored into the analysis.

Like-for-like (L-F-L) sales growth assumptions:

Bull case: 3%

Base case: 2%

Bear case: 0%

For the fiscal year ending 3/30/2025 with one quarter to go, we will use analyst consensus.

It is recommended that everyone do their own financial modeling, but based on these rather conservative assumptions, especially since our bull case assumes growth rates below 10%, the company looks significantly undervalued.

Conclusion

A nearly 50% decline in the share price over the past 12 months, compared to expected earnings decline of only about 6%, has created a significant investment opportunity. The company has double-digit growth, high returns on invested capital, and the potential to continue reinvesting for many years.

While reinvesting, the company's demonstrated ability to reward shareholders through dividends, with 60% of its current market capitalization returned in dividends between fiscal 2021/2024..

The only notable concern is the uncertainty surrounding the new CEO and the reasons for the current CEO's resignation. However, recent share purchases by board members provide confidence.

Disclaimer

This is not investment advice. The author is an investor in the company, and his opinion may be biased. Individuals should conduct their own analysis before investing in this company.

This is a solid summary of B&M stock. It's been on my watchlist for a while and has finally reached my target range. Is anyone else keeping an eye on this one?