Summary

One of the top 5 IT service providers in Germany

81 % of recurring revenues through contracts with an average duration of 4.5 years and inflation linked.

Business model based on CORBOX a tool to "industrialize" IT services.

Strong corporate culture with long-term vision

Founder of the company as a reference shareholder

Business Model

Datagroup is an IT service provider in Germany, with 3500 employees it’s one of the top 5 IT service providers in Germany. The business model is simple to understand, the company divides its operations into two segments:

Solutions and consulting (19 % of revenue): Engages in software development and consulting. This segment operates on a project basis and does not generate recurring revenues.

Services (81% of revenue): Provides services such as cloud, SAP, cyber security, and others. Revenues from this operating segment are recurring with long-term contracts with an average duration of 4.5 years. Previously, these were fixed-price contracts, but due to the increase in inflation in recent years, the new contracts are inflation-linked.

Datagroup's business model is based on CORBOX, a proprietary module-based solution for IT outsourcing services ranging from data center services, network services, end-user services, application management services, SAP services, print services, communication and collaboration services, big data services, service desk, security services, monitoring services, robotic process automation and continuity services.

The platform is scalable and aims to "industrialize" IT services by standardizing processes.

DATAGROUP operates its own hardware and software for CORBOX services in these data centers. The data centers in Frankfurt and Düsseldorf as well as all DATAGROUP locations within the scope are audited annually according to the internationally recognized ISO 27001 standard.

Here is an illustration of the latest contracts they have signed:

The platform was developed in 2014 as part of the "DATAGROUP 2020" strategic plan and has been a success for the company. Not only in terms of recurring revenue from long-term contracts, but also in terms of scalability and improved efficiency thanks to CORBOX, which has increased operating margins from 3.2% to 9.1% with room for improvement.

CORBOX is a source of competitive advantage for the company because of the customers it targets. Datagroup focuses on small and medium-sized enterprises. Large IT companies tend to focus on larger customers, so Datagroup's main competition is a large number of smaller, mostly regionally focused players that may not be as efficient as Datagroup.

The platform also allows the company to be a one-stop shop for all types of services, in addition to having its own data centers. This is a huge advantage when you consider that it is mostly competing with smaller companies.

The company is diversified in both sectors and customers with no single customer exceeding 5% of sales.

The company's core strategy is based on 4 points:

Cross-selling to CORBOX customers.

Acquisition of new CORBOX customers

2-3 acquisitions per year

Renew existing CORBOX customer contracts.

M&A

M&A plays an important role in the company's growth, as it is cheaper to acquire customers this way, with an organic customer acquisition cost of €600,000 versus €400,000 inorganic.

Datagroup has a good track record of acquisitions to complement its growth and they are very strict when it comes to not overpaying, as we can see the average multiples are 3.4 times EBITDA and 4.1 times EBIT, but it must be said that the multiples paid have increased over time due to the entry of private equity in the sector.

The outlook for M&A has improved as rising interest rates have reduced competition causing valuations to fall. Datagroup has already acquired 2 companies in the last 2 months, CONPLUS (DEC 2023) and ITTOTAL (JAN 2024). It is likely that we will see the company quite active in M&A this year, as the recurrence of its revenues at a time when the sector is sluggish may allow it to take advantage of opportunities.

Acquisition criteria

IT service company with its headquarters in Germany

Services provided to German Mittelstand companies.

Annual sales of between EUR 5m and EUR 50m

No industry specialization if possible

High recurring revenues

Employees with specialist knowledge

Regional customer structure at eye level

IT services providing added value to customers.

New technologies, for instance in RPA, AI, cyber security, and cloud

Corporate culture

Datagroup is a very well-run company with a corporate culture based on efficiency and long-term view. Now that we know the business model let's name some events that can give us an idea of the company's culture.

It is a family-owned company founded in 1983 by Max H.-H. Schaber, who held the position of CEO until 2020/2021. Despite his retirement as CEO, Max H.-H. Schaber remains involved in the management of the company. Schaber holds a seat on the supervisory board and has not sold any shares in the company, but has recently bought more, so we expect the culture to be preserved.

In 2013, they were already working on the Datagroup 2020 strategic plan, with the launch of CORBOX in 2014 at the heart of the strategy. When CROBOX was launched, they said the following sentence that clearly describes how this company works.

“IT doesn’t have to work miracles. But she has to do her job. Every day. 100 percent. Like a machine. CORBOX does nothing more and nothing less.”

In 2015 they became one of the few companies allowed to offer Microsoft's Cloud services their own domestic data centers.

In 2018 they launched the Datagroup 2025 strategic plan with the goal of achieving 750 M in revenue in the fiscal year 2025/2026.

In 2019/2020, despite a 14% increase in revenue, profits fell by 98%. A small part can be attributed to COVID, but the majority came from a large risk provision. This was due to delays in services and expenses related to the new clients of a subsidiary in the financial services sector. The company was forced to hire about 100 freelancers for more than 1 year. Management acted quickly, changing the entire local management of the subsidiary and reducing spending on freelancers. In the annual letter, after explaining the situation, the CEO commented, "Such poor performance by one of our subsidiaries was an unprecedented situation and is not acceptable to us.

This last fact shows us the personality of the management. We cannot expect them not to make mistakes, even if they make few, but we can expect a quick and forceful reaction. Moreover, they did not use COVID as an excuse and took responsibility for the mistake.

Starting in 2022, service desk employees who provide customer service will be assisted by CORBOT, which they call a kind of digital "Swiss Army knife" powered by AI. Basically, CORBOT aims to automate ticket classification. Classifying each ticket takes more than two minutes, and more than a thousand tickets are classified per day, saving several thousand hours per year.

Currently, resources are being invested in clould, cybersecurity and the development of proprietary AI-based technology to help automate or facilitate processes to further "industrialize" its services.

The Market

The industry is extremely fragmented and competitive, with a large number of companies that vary greatly in size, service offerings and specialization.

Datagroup focuses on small and medium sized companies as customers, usually competing with smaller companies that cannot offer the same level of services as Datagroup. For these companies it would be impossible to develop a tool like CORBOX and they are not present in all types of services while Datagroup is a one-stop shop.

Datagroup also competes with some larger players, although these generally focus on larger customers.

In an annual survey conducted by Whitelane Research and Navisco AG on consumer satisfaction with their service providers, Datagroup is ranked in the TOP 5 every year.

The German ICT market still has a lot of potential for consolidation for many years to come and there is no dominant company with a large market share. Datagroup being one of the TOP 5 German IT service providers has only a 1 % market share, and we are talking about services only.

Bitkom predicts that the German information technology and communications market will grow by 4.4 percent in 2024.

Capital Allocation

The company has a policy of paying out 40% in dividends and reinvesting the remainder in growth, typically M&A.

Management and Shareholder Structure

Until 2022, the Company was led by Max H.-H. Schaber, founder and majority shareholder with 54.4% ownership. He currently holds a seat on the Supervisory Board.

The second largest group of shareholders are members of management with 4.6% of the capital.

Andrea Baresel is Max's successor as CEO. With a background in business management, he joined Datagroup in 2012 through the acquisition of Consinto.

The company is very well managed and, as noted above, has a strong culture of efficiency and long-term vision.

In 2023, there were several insider buyouts, including Max Schaber, who acquired another 1% of the company, CEO Andreeas Baresel, and Sabine Laukemann, Chief Human Resources Officer, Strategy and Organization.

Financial information

Revenue

Revenue has grown through a combination of M&A and organic growth at a CAGR of 12% over the past 10 years, increasing every year except 2014 and 2023. In 2023, the decline in sales is due to one-time projects of 40 million in connection with vaccination centers and school digitization due to COVID.

Most of this growth comes from M&A, which the company says is cheaper (we do not have organic growth data for all years). Consumer acquisition cost organically according to the company is 600 K, while through M&A is 400 k.

Most of its revenue the recurring, currently 81%.

Margins

Since the introduction of CORBOX margins have been trending upwards including 2023 despite the decline in sales they have continued to improve. The company had a target of 15% EBITDA margin and 9% EBIT margin in 2023 which it has achieved. This does not stop here, without giving an exact number in the last call they said that in the medium term 3-5 years they expect EBIT to reach double digit. This is easily achievable for two reasons, first the D&A on sales should decrease as in 2020 the company finished a capex cycle related to Data centers. On the other hand, the company is still working on AI related tools to improve efficiency as the above mentioned CORBOT.

Free Cash Flow and Net Income

The company has no problem generating cash, although in some years it can be affected by working capital. In recent years, FCF adjusted for working capital has been higher than net income. This is because capex exceeded D&A in the years 2017 to 2020. The capex cycle has ended and is expected to remain at 3% of sales in the future, while D&A is expected to be 5%

Returns on invested capital

The company has decent returns on invested capital that should improve due to improved margins and the end of the investment cycle.

Debt

Debt is 1.8 times EBITDA, a moderate level considering the recurring nature of its revenues.

Peers

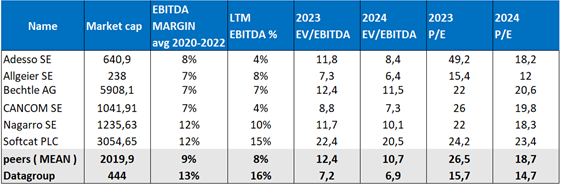

The next peer group consists of several companies, most of which are German, although they also operate internationally.

We can see that Datagroup has better margins than its peers and is selling at a more attractive valuation than most of them.

Valuation

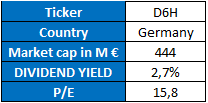

The company is currently trading at 15x P/E, 16.2x EV/FCF and 7.2x EV/EBITDA.

Discounted Cash Flow

We will perform a DCF to try to get an idea of what the company is worth today without considering future mergers and acquisitions.

Discounted Cash Flow

We will perform a DCF to try to get an idea of what the company is worth today without considering future mergers and acquisitions.

The assumptions are based on:

Service and maintenance revenue growth of €25 million per year at the midpoint of the company's organic growth target of €10-15 million per year from cross-selling CORBOX and €10-15 million from acquiring new CORBOX customers, plus a price increase of 2% per year as new contracts are indexed to inflation.

In the Solutions & Consulting segment, we estimate flat revenues in 2024 and 5% annual growth from 2025 onwards due to macroeconomic uncertainty.

We include revenues from acquisitions made in the last two months, of which we can deduct from the information provided that 4 million would be in Solutions and Consulting and 13.2 million in Services and Maintenance.

The actual EBITDA margin with D&A at 5% of revenue and capex (including leases) at 6%.

Using a 10 % WACC and 2 % terminal growth we get to a valuation of 52, 1 € per share.

The DFC and the multiples which the company is trading, suggest the company is at fair value. However, it's important to note that this company has a history of trading at higher multiples due to its highly predictable earnings, consistently trading above 20x earnings and 8x EV/EBITDA.

Management target

Management's target for 2026 is $750 million in sales, with EBITDA above 15% and EBIT above 9%.

This target would depend on M&A with the acquisition of around $150 million in sales over the next 3 years. I will not try to estimate the prices management will pay, as that would be pure speculation, but out of 26 acquisitions made between 2006 and 2021, 21 were at a price below 5x EBITDA.

If this target is achieved, the company would generate an EPS of around 6.2 euros per share, trading at a P/E of 8.6x in 2026. A very attractive valuation given the predictability and recurrence of revenues that have always led the company to trade above 20x earnings.

RISK

Risks related to a downturn in the economy. This risk is not high, as 80% of the company's revenue comes from services that must continue to be provided unless the customer goes bankrupt. The part that would be most affected is the solutions and consulting segment.

The fact that it is dedicated to small and medium enterprises makes its clients more vulnerable.

Commoditization of the cloud that could lead to a price war affecting profitability.

The company's extensive M&A activity, while generally successful, carries inherent risks. In a sector where people are so important, problems in attracting talent could be a risk.

At current valuations, the margin of safety is relatively low, and achieving high returns heavily relies on successful acquisitions.

Conclusion

While the company's valuation may not be considered a bargain, its attractive risk-reward profile, coupled with the potential for significant upside from M&A activity makes it worth keeping on the radar in case of a drop in valuation. The company's recurring revenue stream, with average contract durations of 4.5 years, and strong corporate culture further enhance its appeal.

In a context of macroeconomic uncertainty such as the current one, the company should perform well in any scenario. In a negative economic scenario, the company's long-term contracts should protect its revenues and may even allow it to pursue M&A at a lower price. In a positive scenario, the services side will continue to grow at a moderate pace, but the solutions and consulting side will grow faster.

To conclude, I will edit the previously written sentence that the company used to talk about CORBOX when it was launched in 2014, which perfectly sums up my expectations of this company.

"Datagroup doesn't have to work miracles. But she has to do her job. Every day. 100 percent. Like a machine. Datagroup does nothing more and nothing less."

Disclaimer: This is not an investment recommendation. It's a personal opinion of the author, and everyone is responsible for their own decisions.

Qué opinas de la tesis y la empresa un año después ?