Macfarlane in a Nutshell

Macfarlane is a UK small-cap focused on the distribution of protective packaging. It is the market leader in the UK, with a 25% market share.

The company is currently trading at its lowest valuation for the past 10 years, despite having depressed revenues due to the general economic situation. In addition to its attractive valuation, the company benefits from three key growth drivers:

Demand recovery

Market consolidation in the UK

International expansion, increasing its total addressable market (TAM) X6.

Disclaimer

This is not an investment recommendation. The article includes estimates and accounting adjustments that, in the author's opinion, are necessary, but others may disagree. The author holds a long position in the company, which may introduce bias into their perspective. This is for informational purposes only.

What Does Macfarlane Do?

Macfarlane Group PLC designs, manufactures, and distributes protective packaging, primarily made of cardboard, for businesses.

A Brief History

Founded in 1949 by Lord Macfarlane, the company initially operated as a commercial stationery provider. In 1980, it entered the packaging distribution business through the acquisition of Abbotts Packaging.

The real transformation came in 2003 with the appointment of CEO Peter Atkinson. At the time, five out of the company's seven business lines were unprofitable. Atkinson implemented a new business strategy, divesting non-core operations and focusing on specialized distribution within the UK. The company quickly returned to profitability. In 2021, Macfarlane sold its label production business to concentrate entirely on packaging.

Business Overview

Macfarlane’s core business involves the design, manufacture, and distribution of protective packaging—mainly for transport and storage rather than direct-to-consumer packaging.

Macfarlane’s customers can be divided into three main segments: Retail, Industrial, and Logistics. The Industrial segment is the most significant, accounting for 68% of revenues in 2023.

Business Segments

Packaging Distribution

This is Macfarlane’s primary business line, contributing 87% of revenue and 75% of operating profit.

It's a very simple business model: Macfarlane buys bulk packaging materials from large manufacturers such as Smurfit Kappa and DS Smith, stores them in its 27 distribution centers, and supplies them to its clients.

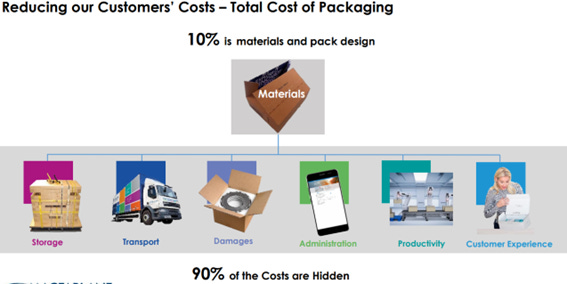

A good question is why customers and manufacturers don’t trade directly. This is because 90% of packaging costs are not materials and design, but other costs such as storage and transportation.

It adds value to manufacturers by dealing with their more than 20,000 customers. Large manufacturers typically serve directly only high-volume clients like Amazon, Nestlé, or Procter & Gamble.

For customers, Macfarlane provides storage solutions and fast delivery (usually within a day). Additionally, due to its scale, Macfarlane secures more competitive purchasing prices than individual businesses could.

Packaging financials

Macfarlane has grown revenue at a CAGR of 7% since 2015, through a combination of organic growth and M&A.

Margins are quite healthy with an upward trend thanks to the increase in scale. If we look at 2023, there has been a significant increase in gross margin, which is not reflected in EBIT. This is because they have passed on increases in certain costs to their customers.

The Distribution Market in the UK

The company primarily operates in the UK but has recently begun expanding into Europe.

The UK distribution market is highly fragmented, with competition coming mainly from local and regional players, while national and international competitors have a smaller presence. Macfarlane is the market leader, currently holding approximately 25% market share.

In the distribution business, scale is one of the few sustainable competitive advantages. Since 65% of the UK market consists of companies too small to operate nationally, Macfarlane enjoys a strong competitive position. One of its key strategies in the UK is to continue to consolidate the market.

International Expansion

The company has recently expanded into Europe, following a follow-the-customer strategy to provide its international clients with products across European markets. It has already made some acquisitions in the region, aiming to replicate its successful UK model.

However, this expansion may present challenges, as European distributors tend to be larger, and the market is dominated by national players rather than local ones, as is the case in the UK.

Thanks to its international expansion, the company has increased its total addressable market sixfold, from £1 billion to £6 billion.

Manufacturing

Macfarlane specializes in designing and producing customized protective packaging solutions. These products are high-value and tailored to customer needs, yielding higher margins.

Manufacturing financials

This segment represents 13% of revenues and 25% of EBIT in 2023. In general, manufacturing businesses tend to have operating leverage and good profitability when they are running at full capacity, but when volumes go down, margins tend to go down. The combination of the two businesses is very interesting, because when volumes drop, they compensate by buying less from other suppliers and manufacturing for themselves, which helps them to always operate at good margins. Since 2021, the business has been more profitable, partly due to the sale of the label business. The funds have been used to focus entirely on packaging.

Capital allocation

The company has allocated between 40% and 50% of its earnings to dividends and the remainder to acquisitions. The following picture shows the company's capital allocation priorities.

Mergers & Acquisitions (M&A)

Macfarlane has a strong track record of acquiring businesses at attractive multiples (5-6x EBITDA). The M&A outlook remains promising, as stricter environmental regulations are making it harder for smaller firms to compete. This trend could create further consolidation opportunities.

This is from the last conference call

On January 13, 2025, they announced the first acquisition of the year.

Management & Shareholding Structure

This is an area of concern.

CEO Peter Atkinson has led the company since 2003, successfully turning it around and creating substantial shareholder value. Operationally, there are no issues.

However, management’s alignment with shareholders is weak. Atkinson owns just 0.93% of outstanding shares—an amount worth little more than his annual salary. The company requires executives to hold shares equivalent to at least 100% of their salary, but this is still relatively low.

The majority of shares are held by institutional investors, with no insider holding a significant stake. Given Atkinson’s strong track record, there’s no immediate reason for concern, but at 69 years old, his eventual retirement could introduce uncertainty—particularly in a business reliant on M&A.

Valuation

The company is set to release its 2024 full-year results on February 27. However, in a press release last November, it indicated that results are expected to be in line with market expectations and broadly similar to those of 2023.

This would imply an EBITDA of £37.27 million, a reported net income of £16.85 million, and an adjusted net income of £19 million after excluding intangible amortization related to acquisitions, such as brand value and customer relationships. This adjustment is necessary as free cash flow typically exceeds reported net income.

Valuation ratios

We are estimating net debt of £19.1 million, which includes an estimate of the cash generated for Q4 2024 and the acquisition made in January 2025.

If we look at the historical valuation, the company is trading at a discount regardless of which metric we use, and while we should be cautious with this type of valuation, it is a good starting point.

Outlook

The company's outlook is promising with three earnings growth drivers.

1. The macro-economy in general is not in good shape and the company has not been immune. Over the past two years, the company has declined more than 20% in organic terms. Analysts are already forecasting a recovery in demand starting in 2025 and expect the company to grow 14% organically.

2. Market consolidation in the UK. Good acquisition pipeline in the UK for the next 4 years, with many local companies looking to sell due to owner retirements.

3. Replication of the model in Europe, which multiplies the TAM by 6.

Conclusion

Not only is the company trading at a discount to its historical multiples, but its earnings are also depressed by the economic situation. If we add the 3 growth drivers to the discount, it looks like an interesting situation for a company that we can conservatively expect to grow between 5% and 10% for many years while paying dividends.

Great article! It often pops up on my screener but I've never taken a closer look.

Do you know how what explains the historically high margins in both segments (gross & EBIT)? Is that mainly due to the acquisitions they have made? It's normally not something I like to see.