Makarony Polskie, one of the leading pasta producers in Poland. The company has had a significant margin improvement from 2023 due to internal and external factors. understanding what the normalized margins can be is key to the thesis.

Business overview:

The company produces pasta, a basic product with a stable demand in any economic scenario.Makarony has 4 production plants in Poland.

Pasta production is energy intensive and price fluctuations affect short-term margins. After a large energy spike in 2022, prices decline and stabilize in 2023 and 2024.

Cereals are a key raw material for pasta production, and their price also declined in 2023, benefiting margins.

Another factor that impacts margins is the type of product, which can change depending on the type of pasta. Premium pasta or pasta that is considered healthier, such as gluten-free, will deliver better margins.

Proximity to the customer is important because pasta is not a good product to travel long distances due to its high volume compared weight.

Its sales are divided into four segments: private label for large supermarket chains (64.5%), own brands (17.4%), B2B and institutions (12.3%) and exports (5.9%).

A key point to highlight is customer concentration: Biedronka and Lidl, two giants of the retail sector in Poland, represent 38% and 14.8% of Makarony Polskie's sales, respectively.While this relationship ensures a steady stream of revenue, it also represents a risk, as the company is highly dependent of these two customers .Biedronka has a market share of over 30% in the food sector in Poland, so customer concentration is common for any company wishing to operate in Poland.

Business development over the years

In 2012, Zenon Daniłowsk, the majority shareholder, took over as CEO and initiated a restructuring process to improve efficiency.Measures included consolidating production, canceling unprofitable contracts, and reducing the workforce.

These actions, while initially reducing sales, increased gross margins from 11.1% in 2011 to a range of 21% to 23% in subsequent years.

In 2018, the company invested PLN 50 million in a plan to increase sales and profitability by entering higher value-added categories of pasta.

These investments led to the creation of the SO-Foods brand in 2019. According to Nielsen's 2023 report, SoFood's Ready-to-Eat is the leader in the segments in which it operates.

Following the investments, the Company focused on debt reduction and at the end of 2021, Makarony Polskie acquired SAS Sp. z.o.o., consolidating its position as a leader in the egg and pasta market. According to the company, this acquisition created synergies that allowed for a better distribution of production and a reduction in fixed costs.

In 2022 and 2023, new products were launched as a result of the 2018-2020 investment plans. In theory, these products generate better margins and part of the improvement in these years may be due to these new products.

The Polish pasta market

The Polish market is fragmented with many small producers. According to IBISworld, there were 458 pasta producers in Poland and the number is decreasing by 1% per annum.

Growth prospects are good and according to Statista, the market is expected to grow by 5.69% in the period 2024-2029.

Management and Shareholders

The company is managed since 2012 by Zenon Daniłowsk, the major shareholder of the company with 32.99 % of the capital.

Another major shareholder is Raya Holding for Technology with 29.48%.Raya Holding is an investment conglomerate based in Cairo. In addition to being a shareholder, it exports Makarony's products to Egypt.

Capital Allocation

The Company has been paying dividends since 2016. The remaining cash generated was invested in capital expenditures to improve the company's profitability and in the acquisition made at the end of 2021. After these investments, the company paid down debt until it reached a net cash position. After these investments and debt repayment in 2024, the Company has announced a share repurchase program, which it is currently implementing for 9.06% of the total outstanding shares. The buyback program is authorized at a maximum price of PLN 20 and the Company buys back shares each time the share price falls below PLN 20.

Financials

Balance sheet

As of June 30, 2023, the balance sheet showed a net cash position of PLN 29 million (13.6% of the current market cap).

Revenue

Moderate growth since 2012 with a compound annual growth rate (CAGR) of 7.9%. This growth may seem low, but it is not bad considering the company's restructuring phase. The company did not break out the data, but we assume that most of the growth in 2022 was inorganic.

Margins

A clear upward trend in margins, reaching their peak in 2023.In 2023, margins are clearly inflated, benefiting from a drop in raw materials.Finding out what the normalized margins are is the key to this investment idea.

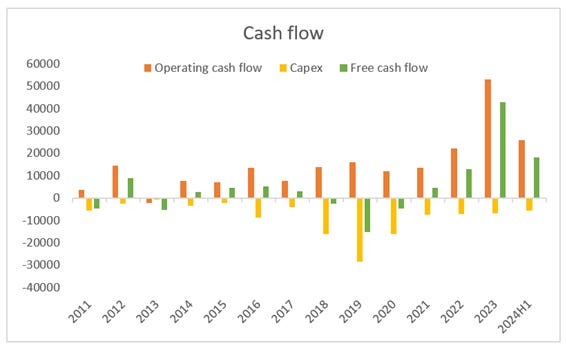

Cash flow

Except for the first years of restructuring and the period 2018-2020 due to the ambitious investment plan, the company has always generated a stable cash flow. No major investments are currently expected.

Back to the Margins

In 2023, the company's gross margin jumped from 22.3% to 27.6%, and in H1 2024, it rose to 30.3%. Of this improvement, we do not know how much is due to external factors (raw material prices) and how much is due to internal factors (investments made by the company).

The first thing to do is to understand if the current margins are sustainable for the industry and how other peers have performed

It was difficult to find direct comparisons because most of the listed companies that make pasta also make other products. Let's take a look at the margins of some peers.

Barilla : This is a company of significant size, with revenues of more than €4.8 billion by 2023. Its gross margins are high thanks to its scale and strong brand.

Ebro Foods : The decline in margins in 2022 and the improvement in 2023 and H1 2024 are due to fluctuations in raw materials and energy, although they also add in their reports that part of the improvement is also due to increased efficiency.

De Cecco : This is the company that we have the least data and only until 2022. Like the others its margins suffered in the period 2021 and 2022.

Newlat Foods : The peer with the worst margins of all. As we can see, decline in 2022 with recovery in 2023, reaching record in H1 2024.

It is clear from this comparison that current margins seems unsustainable and that large part of the improvement is due to external factors and is likely to be temporary.

Now let's look at what internal factors may have contributed to the improvement of margins.

CAPEX investments (2018-2020): Investments focused on optimizing processes and launching higher-margin products. Some of the products resulting from these investments did not reach the market until 2022 and 2023.

Acquisition of SAS Sp. z o.o (end of 2021): Nearly doubled the company's revenue and increased its scale. According to the company, synergies were generated, saving on fixed costs, so that in 2022, despite the fact that the company's gross margin had been consistent with previous years, EBITDA was 12.9%.

Photovoltaic installation (H2 2024): Operational in all plants from H2 2024, contributing to cost savings

Conclusion on margins

Maintaining current margins seems impossible, but an improvement over historical margins is likely, particularly due to savings in fixed costs.

A margin similar to 2022 should be sustainable and could even improve slightly, as products resulting from CAPEX investments were launched during 2023 and the photovoltaic installation was completed in H2 2024.

Valuation

The company currently trades at a 6x LTM P/E despite having net cash of 13.6% of market cap. The market is clearly expecting margins to decline, which I agree with, so the current valuation doesn't mean anything.

We will run two simple scenarios for 2025.

We will assume that the decline in sales for the whole of 2024 will be 16% like H2, although I think it will be lower as the price declines started in H2 2023. During 2025, we simply assume that the company grows at the expected market rate (5.69% according to Statista).

In terms of margins, we will assume margins similar to 2022 for the base case and similar to historical levels for the bear case.

Conclusion

The company has historically traded at low multiples of 5x EV/EBITDA and 9x P/E despite being in a stable and resilient industry.

The market's expectation is clearly that there will be a decline in margins.The investment is not without risk. There is a risk because it is not clear what part of the margin improvement is due to internal factors.

At current multiples, it does not look like a bargain.

Nevertheless, I find the company attractive for the following reasons:

We are coming out of a capex cycle. We are not expecting a lot of capital spending.

I expect the cash generated by the company to be used either to continue to reward shareholders or to pursue M&A transactions that will enhance earnings.

The CEO being the largest shareholder is an important factor because capital allocation will be very important.

It seems that the market is already expecting margins to return to historical levels. I personally think that margins will drop but remain above historical levels thanks to the investments that have been made. If the company's efficiency measures work, the valuation will be much more attractive.

The company has 29 million net cash (13.6% of market cap), which it uses to buy back shares every time the price drops below PLN 20 making it difficult for the share price to drop much below these prices. I think the large cash position limits our downside.

Disclaimer: This is not an investment recommendation and is the personal opinion of the author who is not responsible for the decisions of any third party.