Performance: 4.72%.

Today marks our first quarter since I began publishing my portfolio and movements. With a positive result of 4.72%, I am satisfied given the current context in the markets.

Given the current market environment, I am satisfied with a positive result of 4.72%.

First, let's look at the changes in the portfolio:

Portfolio as of 01/01/2025

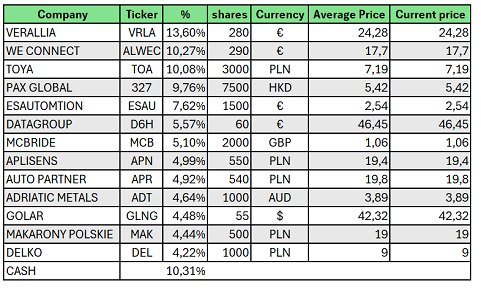

Portfolio as of 31/03/2025

Transactions

Sales

During the quarter, we completely sold two positions, Adriatic Metals and Delko, and reduced our weight in Verallia and Pax Global. The reasons for the sales are as follows

Adriatic Metals: The current price seemed adequate to me, considering the risks involved in a mine that has already experienced ramp-up delays.

Delko: Although the company still seems to be trading at an attractive price, I preferred to allocate that capital to other companies that also trade at low multiples but are better managed, such as Groupe Guillin or Macfarlane.

Verallia and Pax: Both reductions were for similar reasons. The recovery in their sectors is taking longer than expected, and although I like both companies and have no problem waiting while they pay a good dividend yield (Verallia 5.94% and Pax Global 10%) , there are opportunities that I hope will be realized sooner.

Purchases

During the quarter, there were 4 additions: Zegona, B&M, Macfarlane, and Groupe Guillin. Two of these new additions, Zegona and B&M, are my top holdings.

Macfarlane and B&M were my last two analyses, which I leave below, so it's not worth going into detail about them.

https://10baggernewsletter.substack.com/p/b-and-m-european-value-retail-a-bargain

https://10baggernewsletter.substack.com/p/macfarlane-group-the-full-package

Zegona is a turnaround, it is not an original idea and has come to me thanks to Gabriel Castro @gabcasla, manager of Sigma International. In the following link you can read Dave Waters talking about the company.

Groupe Guillin is a French family business that mainly produces plastic food packaging. The business is defensive, but the company is not going through its best moment due to a combination of price drops from lower raw material costs and weak volumes. Currently, the company has a lower-than-usual debt level, which will probably result in M&A. If we add an eventual recovery in volumes and a P/E ratio of 8, it seems like an attractive situation.

Disclaimer : This is not an investment recommendation.